Buying a rental property out of state can have benefits and drawbacks. This article will explore the rewards and challenges involved in doing so. It also addresses financing options. Private mortgage loans are one option, but there are many other options. For advice and information on the market, consult a local realty agent.

Investing abroad in a rental home

It is possible to invest in rentals properties outside your state. Many people in expensive areas will find that there are cheaper properties in other areas. This can mean a greater profit for the investor. Investing in rental properties outside your state can also help you diversify your portfolio.

Another reason to rent properties in other states is the geographic diversity. This is a big advantage. By investing in rental property in multiple locations, you can diversify and protect your portfolio. Each area, county, or town is different, so market declines in one place may not have the same effects on another.

Challenges

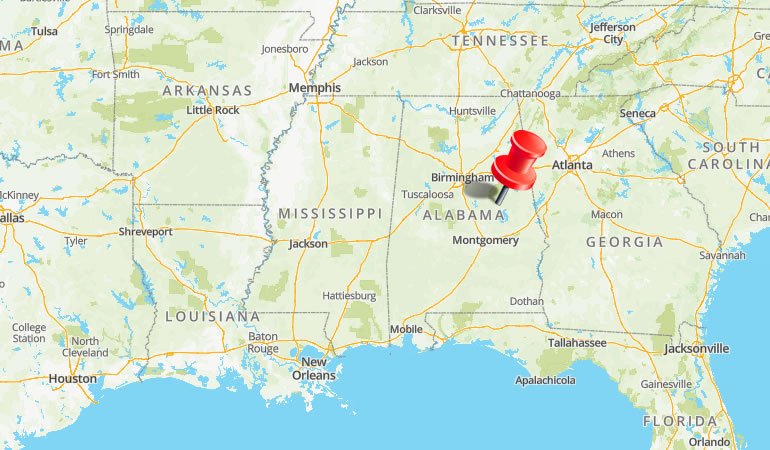

You should be aware that renting property outside of your state can be difficult. Although you might make higher profits in markets outside of your home state, you should spend more time getting to know the area. It is important to research the local area online before you start looking for the right properties to rent.

If you want to diversify and grow your real estate portfolio, purchasing property out of state can be a wise move. It can however be expensive and time-consuming.

Reward Program

You can reap many benefits by investing in rentals outside your home. It can diversify your rental portfolio and lower the risk of total loss in one area. Second, each state, county, and town has its own economic system. This means that markets in adjacent areas may not be affected by a decline in one location.

Additionally, renting out of the state can diversify an investor portfolio and provide passive income. It is important that you are aware of the potential risks and benefits associated with renting your property. The laws that govern landlord-tenant relations vary from one state or another, even within one state. These laws can impact how tenants are screened and whether they accept rent increases or decline lease agreements.

There are many financing options

If you're looking to invest in rental property out of state, you may have to navigate additional hoops in securing financing. It is best to do your research on financing options before you start looking at properties. This will make it easier to find the right property, and reduce surprises.

Another option is to approach banks or other lending institutions. If you can show that your landlord track record is good and you are a reliable risk, banks or lending institutions will be more open to you. A down payment of at most twenty-five percent will be required. This will help you pay lower interest rates and lower debt-to-income ratio.

FAQ

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This guarantees that your interest rate will not rise. Fixed-rate loans come with lower payments as they are locked in for a specified term.

What flood insurance do I need?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Learn more about flood insurance here.

What amount should I save to buy a house?

It all depends on how many years you plan to remain there. You should start saving now if you plan to stay at least five years. However, if you're planning on moving within two years, you don’t need to worry.

What are the chances of me getting a second mortgage.

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is used to consolidate or fund home improvements.

Is it possible sell a house quickly?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. But there are some important things you need to know before selling your house. First, you need to find a buyer and negotiate a contract. Second, prepare your property for sale. Third, advertise your property. Finally, you need to accept offers made to you.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Purchase a Mobile Home

Mobile homes are houses constructed on wheels and towed behind a vehicle. Mobile homes are popular since World War II. They were originally used by soldiers who lost their homes during wartime. People today also choose to live outside the city with mobile homes. These houses are available in many sizes. Some houses are small while others can hold multiple families. Even some are small enough to be used for pets!

There are two main types of mobile homes. The first type of mobile home is manufactured in factories. Workers then assemble it piece by piece. This is done before the product is delivered to the customer. A second option is to build your own mobile house. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. You'll also need to make sure that you have enough materials to construct your house. Final, you'll need permits to construct your new home.

If you plan to purchase a mobile home, there are three things you should keep in mind. Because you won't always be able to access a garage, you might consider choosing a model with more space. A larger living space is a good option if you plan to move in to your home immediately. Third, you'll probably want to check the condition of the trailer itself. Problems later could arise if any part of your frame is damaged.

You should determine how much money you are willing to spend before you buy a mobile home. It is important that you compare the prices between different manufacturers and models. Also, look at the condition of the trailers themselves. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

You can also rent a mobile home instead of purchasing one. Renting allows the freedom to test drive one model before you commit. Renting isn't cheap. Renters usually pay about $300 per month.