There are many options to generate passive income with real estate. There are several ways to make passive income from real property. These include house flipping, REITs, Peer-to peer lending, and renting property. This article explains the basics behind passive income from real property. These tips will help you make your investment successful if you don't have the funds. Find out more about passive revenue from real estate. You will be able to achieve your real estate goals with just a few simple steps.

Properties to rent

Renting properties can be a great way to generate passive income through real estate. Although you should select the right tenants to avoid problems, there are some things that you can do to maximize your income. It is important to screen prospective tenants thoroughly and keep an eye out to see if there are any vacant spaces. If you fail to screen potential tenants carefully, you may end up losing money, having to endure a lengthy eviction process, or even a lawsuit.

Flipping houses

There are many sources of passive income that house flipping can bring you passive income. To generate income, fixer-uppers and foreclosure properties can be flipped. These homes can be turned into fully-renovated, fully-rented rental properties or turnkey rental homes. The property can be rented and managed by the new owners. House flipping is a popular, lucrative way to earn passive income. The process can be streamlined using technology.

Peer-to-peer lending

Passive income options are many when it comes investing in real property. For example, single-family homes can be more hands-off than apartment buildings. Other than paying the rent, you will also have to manage the property, pay the insurance and monitor the maintenance. It is possible to make passive income by investing in storage facilities. There is a high demand for these properties in every region of the United States. You can make passive income by renting out your spaces and letting them to tenants.

REITs

Passive income from real estate REITs offers a great way to diversify portfolios for the average investor. These securities have low investment cost, with units as low $500. You must be aware that REITs must pay at least 90 percent to shareholders if they want to generate income from real property. Less money can be reinvested. This article will discuss why passive income from real-estate REITs is a great option.

Storage facilities

The self-service facility you own can help you generate passive income throughout the year. Although some areas are seasonal like Quebec, there is a constant demand for space. Depending on where the storage facility is located, you may have multiple customers all year. Below are some revenue-generating ideas that storage facilities can use. Although some of these ideas will require you to put in a lot of effort and time, they will bring you steady income.

FAQ

How long will it take to sell my house

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It may take 7 days to 90 or more depending on these factors.

Is it possible sell a house quickly?

If you have plans to move quickly, it might be possible for your house to be sold quickly. But there are some important things you need to know before selling your house. First, you must find a buyer and make a contract. You must prepare your home for sale. Third, you need to advertise your property. Finally, you need to accept offers made to you.

What is the maximum number of times I can refinance my mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. You can typically refinance once every five year in either case.

Should I use a mortgage broker?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. Before signing up for any broker, it is important to verify the fees.

Do I need flood insurance?

Flood Insurance protects you from flooding damage. Flood insurance can protect your belongings as well as your mortgage payments. Learn more information about flood insurance.

How much should I save before I buy a home?

It depends on how long you plan to live there. It is important to start saving as soon as you can if you intend to stay there for more than five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

What are the key factors to consider when you invest in real estate?

First, ensure that you have enough cash to invest in real property. If you don’t save enough money, you will have to borrow money at a bank. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

It is also important to know how much money you can afford each month for an investment property. This amount should include mortgage payments, taxes, insurance and maintenance costs.

You must also ensure that your investment property is secure. It would be best to look at properties while you are away.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

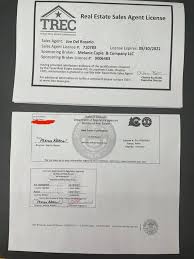

How to become an agent in real estate

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires studying for at minimum 2 hours per night over a 3 month period.

After passing the exam, you can take the final one. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!