Investors are an excellent way to grow your realty business. They buy and sell properties at a high pace, and can often unlock a large number of referrals.

While working with investors is a different experience than selling to residential buyers it can still be rewarding. The first step is to get to know your investor client and their needs. This will enable you to tailor your service to them.

Make sure to get to know the preferences of your clients and learn about their favorite property types and strategies. Also, discover which neighborhoods are attractive to you. You can then show them listings that will meet their needs.

Understand the language of investors and how they work with tax and financial professionals

The world of real estate investing can be very confusing, especially for a newcomer. Investors want their agent to speak their language, and they expect answers to their questions quickly. Investors want their agent to be fluent in terms such as "hurdle rate", "cap rate" and "internal return of return." This will also require a good understanding of 1031 exchanges and real estate math beyond just entering numbers into a calculator.

Create a system to manage offers and transactions

A lot of investors have a limit on the number of deals they will submit per month. It is important to find out this information early on in order to be ready. Depending on how much time and effort you have, this could be small or large.

Apart from being able to identify their needs and creating a plan, you will also need to build a trusting working relationship from the very beginning. Let them know what type of deals they are interested and how often they might make an offer. Be open about what you don’t want them doing, or not doing.

Be a local market expert

An investment realty agent is expected to have a deep understanding of the community in which your clients are interested in investing. This includes understanding which areas are hot and which are slowing down.

It is important to be aware of any off-market property or pocket listing that isn't available on Zillow. This is a valuable resource for investors looking for investment opportunities. These homes might need some work or be in an area that isn’t suitable for traditional sellers.

Create a list to identify preferred contractors and service providers

Real estate agents will often be asked to make repairs to the properties of clients. This can include painting, flooring, and more. For these projects, be ready to provide referrals and estimates.

Let them know how they can benefit from your experience and talents as an agent in real estate.

No matter whether you're an investor or a real estate agent, making connections is key to success in your realty business. A solid network and a track-record will help you attract clients that can make your business a source of income.

FAQ

What is the cost of replacing windows?

Replacing windows costs between $1,500-$3,000 per window. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

Should I use a broker to help me with my mortgage?

A mortgage broker may be able to help you get a lower rate. Brokers have relationships with many lenders and can negotiate for your benefit. Some brokers receive a commission from lenders. You should check out all the fees associated with a particular broker before signing up.

Can I buy a house in my own money?

Yes! There are programs available that allow people who don't have large amounts of cash to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. More information is available on our website.

Do I need flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance protects your possessions and your mortgage payments. Find out more about flood insurance.

What is the average time it takes to get a mortgage approval?

It depends on several factors including credit score, income and type of loan. It generally takes about 30 days to get your mortgage approved.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to become an agent in real estate

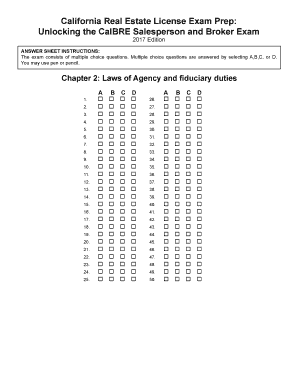

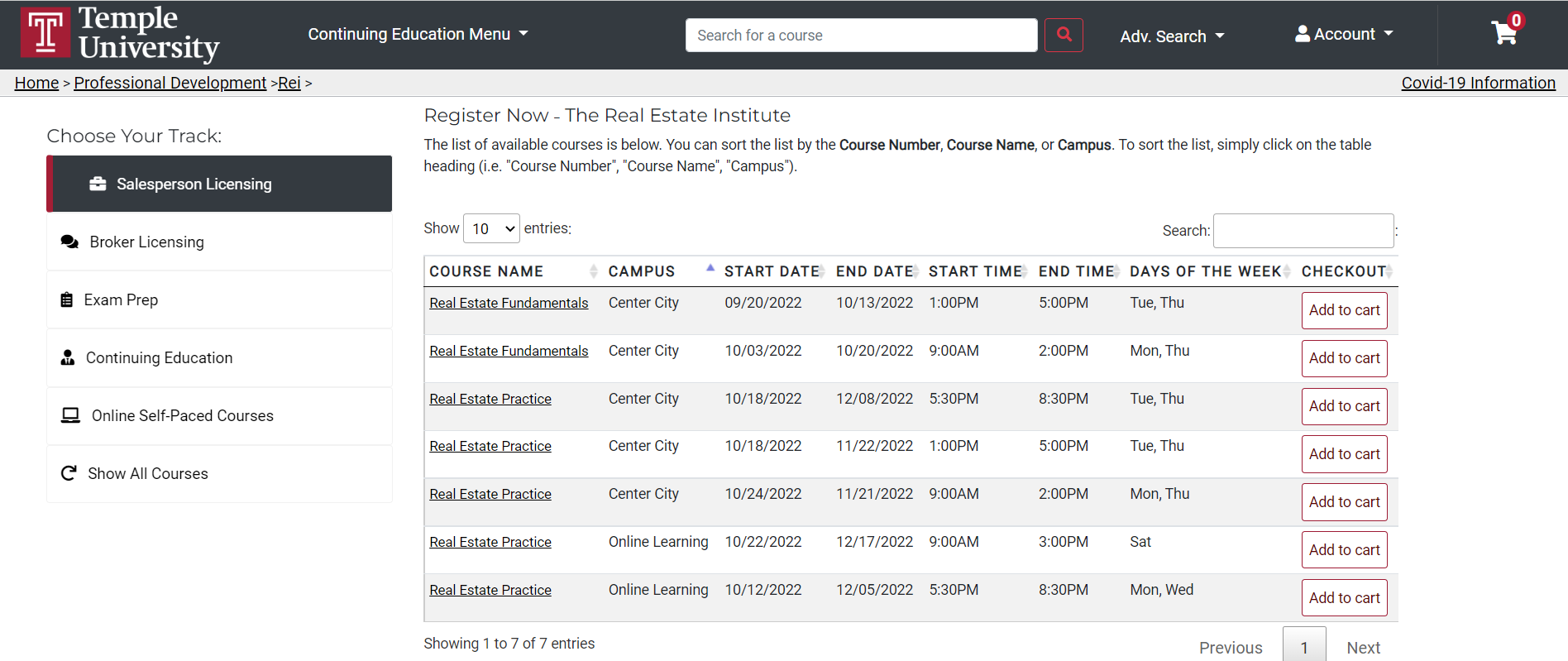

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires studying for at minimum 2 hours per night over a 3 month period.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!